Thresholds of criminal liability for tax evasion under Art. 212 of the Criminal Code in 2017

Which amount of tax notification-decisions would become intimidating this year?

The increase of the minimum wage, to which a large number of charges and settlements of accounts in the state are tied, is not the only thing, which has been increased by the Law of Ukraine (hereinafter – “the Law”) “On the State Budget for 2017” No. 1801-VIII as of December 21, 2016.

The minimum poverty line for the employable person in 2017 has been traditionally increased by the Law “On the State Budget for 2017”, which since January 1, 2017 constitutes 1600 UAH.

At the same time precisely this indicator is decisive for determination for thresholds of the criminal liability for tax evasion provided by Art. 212 of the Criminal Code of Ukraine (hereinafter – “the Criminal Code”).

In particular, tax evasion in considerable, large and especially large amounts is determined in the case of non-receipt of tax payments to the state budget in amount, which is in 1000 and > 3000 and > 5000 and > respectively, higher than the tax-free minimum incomes (the Note to Art. 212 of the Criminal Code). In its turn, the tax-free minimum income is equal to 50% of wage for the employable person under para. 5 of subsection 1 of Section XX and subpara.169.1.1 of the Tax Code of Ukraine.

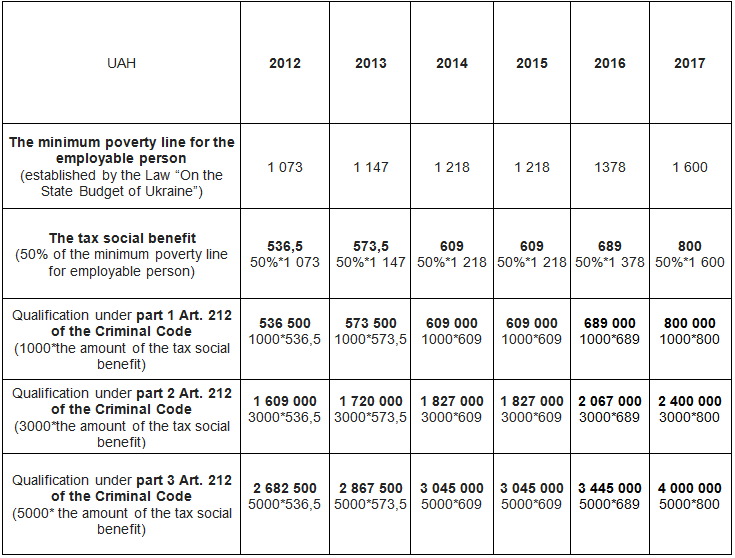

It means that the tax-free minimum income is 800 UAH (50% from 1 600 UAH). Therefore, the qualification of liability under Art. 212 of the Criminal Code in 2017 will be carry out under thresholds rates as follows (for convenience it is provided in comparison with thresholds in the previous years):

For more details about necessity of the significant legislative increase of thresholds of the criminal liability under Art. 212 of the Criminal Code of Ukraine, please read newsletter by the link.

The above commentary presents the general statement for information purposes only and as such may not be practically used in specific cases without professional advice.

Kind regards,

SIMILAR POSTS

Thresholds of criminal liability under Art. 212 of the Criminal Code of Ukraine starting from January 01, 2018 ![]() 64686

64686

The prosecutor’s office has lost powers of pre-trial investigation of crimes prosecuted by the State Bureau of Investigations ![]() 13683

13683

Criminal liability for rulemaking, which leads to decrease in tax revenues ![]() 3070

3070

Criminal proceedings for tax evasion in the first half of 2017: “ghost” of tax police and “efficiency” of the court ![]() 3211

3211

Verdicts in criminal proceedings for tax evasion in the first half of 2017 ![]() 3767

3767

Pre-investigation on the tax evasion (Art. 212 of the Criminal Code of Ukraine): is it now only about the deputies and the authorities? ![]() 9896

9896

Criminal proceedings for tax evasion in the first quarter of 2017: verdicts, trends and statistics ![]() 3280

3280

Legalization of [unlawful] tax audits within criminal proceedings? ![]() 2915

2915

Presentation on “Unlawfulness of tax audits appointment within criminal proceeding” ![]() 3064

3064

Criminal liability for tax evasion – how it was corroborated by the courts in 2016 and what are the real sanctions ![]() 22061

22061

Criminal proceedings for tax evasion in 2016: verdicts, trends and statistics ![]() 3688

3688

Criminal liability under the Tax Code ![]() 6176

6176

Leave a comment

Leave a comment